The 1st

Workshop on Financial Data Analysis was co-organized by Hong Kong Institute for

Data Science (HKIDS) and School of Data Science, CityU held on 14th

Nov 2018. The workshop aimed to bring

together a unique group of active researchers from academia and industry to

share with each other the latest research on the fusion of data science and

finance. All participants had a group photo for memory.

Before the

workshop, I have took a photo with Prof. Duan Li (Acting Dean and Chair

Professor of Operations Research, School of Data Science).

I met Dr. Inez

M. Zwetsloot (Assistant Professor, SEEM) and we had attended ANQ Congress 2017

in Nepal together.

I also took a

photo with Dr. Wen Zhang (張雯) (Senior Manager,

Vector Lab, Risk Management Department, JD Finance (京東金融)) for memory.

In the

beginning, Prof. Duan Li gave welcome address. He briefed the aim of the

workshop and introduced School of Data Science.

The first

speaker was Prof. Tony He (University of Technology Sydney) and his topic

entitled “Information Diffusion and Speed Competition”. He briefed the Publicly

available information for Trader and Firm.

Fast Information and Fast Trading as well as information diffusion and speed competition affecting market quality were discussed.

His key ideas

included that informed traders’ trading intensity was a substitute to slow

informed traders’ trading intensity but a complement to fast traders’ trading

intensity. With speed hierarchies, there

was the significant crowding-out effect, however market quality is improved.

Finally, Prof.

Li introduced the Trading Intensity Interaction model as following diagram.

The second

speaker was Dr. Wen Zhang (JD Finance) and her presentation named “Data-Driven

Asset Management of Defaultable Products in Consumer Lending”. Firstly, Dr. Zhang introduce JD Finance which

was a technology company serviced financial organizations. Her talk included the consumption finance in

internet and personal credit management as well as credit risk management.

Internet

finance had very large scale and different financial products. They were belong to Consumption Finance

Platform with four key elements included attracting customer capability,

customer experience, risk control and capital cost.

Then Dr. Zhang

briefed the personal lending credit and after lending management. After lending management had static

monitoring and dynamic monitoring.

Dr. Zhang and

then briefed dynamic monitoring considered the consumer’s SMS, IVR, Salary and

asset, etc.

Lastly, She

mentioned different solutions for risk calculation and management that employed

AI neural network included Federal Transfer Learning that could solve the

personal data security problem.

Prof. Nozer D.

Singpurwalla (CityU) was the third speaker and his topic was “Updating Personal

Probabilities (The Essence of Data Science?)”.

Prof. Nozer said a key tool underlying data science, be it machine

learning, deep learning, pattern recognition, or AI is Bayes’ Law.

“Bayes’

Theorem plays a central role in Pattern Recognition and Machine Learning.” Said

by Prof. Nozer and then he explained the Bayesian Probability and Bayesian

Statistics.

Then he

briefed the Bayesian Conditionalization that also known as Confirmation Tenacity

and also to be Mechanical Updating.

However, Bayes’

Law was not able to apply when a surprise event occur (e.g. New York on 911).

Dr. James Lei

(ASTRI) was the fourth speaker and his presentation entitled “AI and Big Data

for Financial Investment”. Firstly, Dr. Lei introduced ASTRI technologies

divisions and core competence groups.

Then Dr. Lei briefed

the different between Traditional IT and FinTech that Traditional IT served the

financial industry but FinTech redefined the boundary between quantitative

science and ICT that was cross-layer innovation.

After that he

mentioned that separated computation model and infrastructure model. The infrastructure model between Central and Distributed.

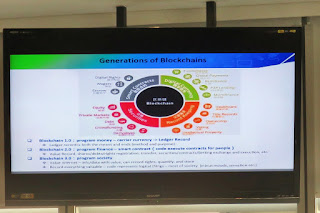

Lastly, he

described the different generations of blockchains from 1.0 to 3.0.

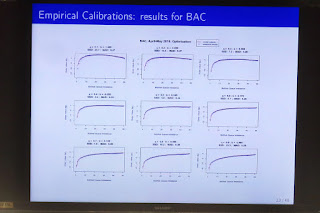

Prof. Xuefeng

Gao (CUHK) was the fifth speaker and his topic named “Stochastic Modeling for

Limit Order Valuation”. Prof. Gao discussed market simulator and findings as

well as empirical calibration and validation.

He said that

major financial markets were now electronic and exchanges provided a limit

order book to maintain the collection of bids and offer and a matching engine

to match buyers and sellers and execute trades. He introduced the estimation of

the transition matrix P of microprice using frequency of transitions and then

showed the calibration results for BAC.

At the end, Prof.

Gao introduced Multi-Armed Bandit (MAB) Algorithms which balance exploration

and exploitation. Generally favor the

most promising arm/option but with some amount of exploration. He concluded to develop a stochastic model

for predicting the expected profit of limit order at best quote for large-tick

assets.

Afternoon Session

The sixth

speaker was Dr. Qi Li (Hong Kong Monetary Authority) and his presentation topic

entitled “Model Risks of Advanced Data Analytics’ Application in Finance”. Dr. Li said AI and Machine Learning were

rapidly adopted for applications in financial industry. However, the validation was important.

Then Dr. Li

pointed out some challenges in Model Risk Management of AI/ML such as Data,

Methodology, Processes and Governance.

Finally, he

had some questions of model validation for AI/ML models included Q1 about

efficient validation; Q2 Biased in Prediction and Q3 Confirmation Bias.

The seventh

speaker was Dr. Qi Wu (CityU) and his presentation named “Parsimonious Learning

of Financial Asset Tail Dynamics”. Firstly, Dr. Wu briefed some background such

as setting bank capital requirement – Basel Committee on Bank Supervision (BCBS,

2016).

Then he

introduced his research question about conditional quantiles exhibit different

lengths of memory at different levels of probabilities.

Lastly, he

discussed his model named Long short-term memory (LSTM) - HTQF and its advantages.

Prof. Yanchu Liu (Sun Yat-sen University) was the eight speaker and his topic was “Textual Sentiment, Option Implied Information and Equity Return Predictability”. In the beginning, Prof. Liu briefed some literatures about Sentiment and options markets.

After that Prof.

Liu mentioned some findings included predict single-stock option market

variables both firm-specific sentiment and aggregate sentiment; and Aggregate

negative sentiment was a strong predictor.

He said option market variables where sentiment was partialled out

remain significant predictors.

Lastly, he

told us his study data from Nasdaq articles from 2012-2015.

The last

speaker was Dr. Gilbert Wang (China CR Capital Holdings Limited) and his

presentation named “High-Frequency Trading and Cross-border Arbitrage Trading

Strategies”.

Firstly, Dr.

Wang briefed the Algorithm Trading that was automated orders and no human

intervention with high speed execution that only relied on data.

High Frequency

Trading (HFT) occupied significant shares in US and Europe market with

extremely low latency (said micro second).

At the end, Dr. Wang showed the Risk Management Framework using Data Science to assist HFT and reducing risk.

Reference:

CityU School of Data Science - https://www.cityu.edu.hk/sdsc/

沒有留言:

發佈留言