HKQAA Symposium is flagship annual event organized by Hong

Kong Quality Assurance Agency (HKQAA) on 18th May 2018. Hong Kong Society for

Quality (HKSQ) is one of supporting organizations since 2006. The symposium’s frame in 2018 entitled “Towards Sustainable Economy: Diversgent Thinking in Business Strategies” and I would like to summarize it below for sharing. Before the symposium, I took a photo with HKQAA friends in front of the

symposium banner.

(Left: Dr. Micheal Lam (CEO, HKQAA), Ir. Dr. Hon Lo Wai Kwok (Chairman,

HKQAA), Dr. Nigel

Croft (Chairman, ISO/TC 176/SC 2 (Quality Systems); Associate Technical

Director, HKQAA)) and I)

(Left: Prof.

KC Ho (Dean, School of Science and Technology, OUHK), I and Prof. Stephen WK Ng

(President, The Institute of Purchasing & Supply of Hong Kong))

(Left: Mr. Bryan Peng, I and Ir C.S. Ho (Deputy

Chairman, HKQAA))

Morning

Session

In the

beginning, Ir. Dr. Hon Lo Wai Kwok (Chairman, HKQAA) gave a welcome speech. He said sustainability is an important

business issue today. Government were

encouraging enterprises to help achieve the United Nations Sustainable

Development Goals (SDGs) through various regulations and incentives for

implementing green finance. This year symposium aimed to bring together ideas

and navigate new strategic directions, so as to create both economic and social

value in the community.

And then

Ir C.S. Ho (Deputy Chairman, HKQAA) gave an opening remarks. He said business world entered to the era of

sustainability. HKQAA promoted

sustainability more than ten years and assisted enterprises to catch this

trend. He introduced that HKQAA directly

took part in the technical committee of ISO/TC 207/SC 4 and its related working

group to develop ISO/NP 14030 Green bonds – Environmental performance of

nominated projects and assets.

MoU

Signing Ceremony – HKQAA and Hong Kong Polar Research Institute

The first speaker was Dr. Nigel Croft (Chairman, ISO Technical Subcommittee on Quality Systems) and his topic entitled “Role of ISO Standards in Promoting Green Finance and Sustainable Business”. Firstly, he mentioned the mission of ISO that supported sustainable and equitable economic growth and promoting innovation and protect health, safety and the environment. He also quoted Kofi Annan (Nobel Peace Prize 2001) statement on ISO General Assembly Sep 2004 that “ISO standards are crucial to sustainable development as they are key source of technological know-how”.

Then Dr. Nigel Croft introduced Green Bonds standards including ISO 14030-1, -2 & -3. He said green debt instruments used to enhance and promote financing of environmental improvements that included not limited to green bonds. Green Bonds used to allocate funds towards projects and assets that could result in potential environmental benefits such as aligning with global climate goals and conserving natural resources.

The

scope of ISO 14030 standards covered Green Bonds and various types of

fixed-income investments, but not equity products. The definition of “Green” is “set of

attributes that demonstrates a net environmental benefit”. Environmental goals /issues/ policy included

followings:

-

Climate change mitigation

-

Climate adaptation

-

Healthy natural habitats including protected and enhanced biodiversity

-

Water resource management and conservation

-

Waste minimization

-

Pollution prevention and control

ISO

14030-1 related Green Bond Principles and requirement on performance

ISO

14030-2 focused on Taxonomy

ISO

14030-3 provided requirements for verification

And then

Dr. Nigel Croft briefed the timeline of ISO 14030 series that it expected to be

published in Nov 2019. He said the

standards’ role supported UN 2030 Sustainable Development Goals. Finally, he concluded that using the

standards wisely, and they could help to promote Hong Kong’s sustainability

initiatives.

Mr.

Joseph HL Chan (Under Secretary for Financial Services and the Treasury, the

Government of the HKSAR) was invited to give the Keynote Remarks. He said investment on green project increased

since 2016. Many Chinese banks were actively in green financial product

including insurance in liability of green or pollution. Green development mechanism on funding in

China was establishing. Hong Kong as a

Financial Centre in Asia that government committed to environment and provided

green bonds and insurance service.

Mr.

Daniel Wong (Director and Head of Research & Analytics, Hang Seng Indexes

Company Limited) was the third speaker and his presentation named “Strategic

Values of Sustainable and Responsible Investment”. His talk content included Values of

Sustainable and Responsible Investment (SRI) and Ecology to Drive the Growth of

SRI.

Mr. Wong

said Sustainable Business considered not only Economic Costs but also concerned

Environmental Costs. He raised some examples of sustainable practices in

Business included Fossil fuels vs Renewable energy, Paper documents vs

Electronic correspondence, and Traditional model vs New designs to reduce

waste. Then he mentioned 7 Sustainable

& Responsible Investment Strategies in the following diagram.

And then

Mr. Wong briefed SRI benefit to Business, Investors and Society. On the other hand, SRI had challenges such as

“No universal standards”, “Limiting investment choices” and “Media

allegations”. However, the growth of SRI

Asset was very high especially in Japan through government promotion.

After

that Mr. Wong briefed Hong Kong situation that HKEX strengthened the

Environmental, Social and Governance (ESG) Reporting Guide in the listing rules

since Dec 2015. In China, China Securities Regulatory Commission also set up

ESG Reporting Guide in Dec 2017.

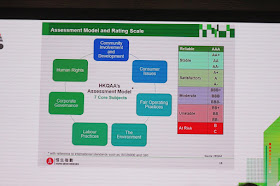

Finally, he stated HKQAA Assessment Model in 7 core subjects and they were “Community Involvement and Development”, “Consumer Issues”, “Fair Operating Practices”, “The Environment”, “Labour Practices”, “Corporate Governance”, and “Human Rights”. Lastly, Mr. Wong briefed the ecology to drive SRI included Fund Managers, Listed Companies, Index Compilers and Investors & Asset Owners. He concluded that Hang Seng Corporate Sustainability Index could aspire to be the best which embraced ESG and Sustainable Investment.

The fourth speaker was Mr. Mushtaq Kapasi (Chief

Representative, Asia-Pacific, International Capital Market Association) and his

presentation topic was “Recent Developments of International Green Finance

Principles”. Firstly, Mr. Kapasi

mentioned some challenge on the transition to a sustainable global economy.

Then Mr.

Kapasi introduced the Green, Social and Sustainability Bonds to us. Because of high market potential, socially

responsible and ESG investing was becoming a mainstream approach in financial

markets. Annual Green Bond issuance had

multiplied 13x since 2013 to over US$155 billion in 2017; as well as, Social

and Sustainability Bond issuance had grown 17x since 2013.

After

that he briefed the principles of Green Bond and Social Bond. There were four pillars and external review

recommendations included “Use of Proceeds”, “Process for Project Evaluation and

Selection”, Management of Proceeds” and “Reporting”.

Finally,

Mr. Kapasi mentioned the market development of green finance activities

included Market Led and Official Sector Led participation.

During

Tea break, I met my CityU SEEM students and took a photo for memory.

(Left: Ms.

Natalie LAW (WTT HK Ltd; HKSQ Exco member), Ms. Fion Chun Ka Po (Hip Hing

Engineering Co., Ltd.), I, Ms. Sindy Lai (Shiu Wing Steel Limited) and Ms. Kwok

Hau Yee (Urban Property Management Ltd.))

I also

met CityU EngD Cohort Dr. Amie Lai.

Panel Discussion I – How Green Finance Can Help

Improve Environment and Foster Development

Dr Nigel

Croft (Chairman, ISO Technical Subcommittee on Quality System) was a

facilitator and Panelist included (Left) Dr. Raymond Yau (GM, Technical Services

and Sustainable Development, Swire Properties Limited), Mr. David Pan

(Treasurer, MTR Corporation Limited) and Mr. Cui Hanling (Managing Director of

Board Office, Modern Land (China) Co., Limited).

Dr.

Nigel Croft asked what motivations for Green Bond / Green Finance were? Mr. David Pan said to expansion of the investment

base and support HK to be Green Finance Hub.

Dr. Raymond Yau said to development the Green Bond platform. Mr. Cui Hanling said it was different from 20

years ago. At that time, investors would

ask why Green but now it was the mega trend.

Panel Discussion II – Shape a Sustainable Capital

Market in Great Bay Area: From ESG to Green Financing

Dr.

Wilson Chan (Associate Director, MBA Programme, City University of Hong Kong)

was facilitator of this panel discussion.

We both are member of CityU Eminence Society.

Panelists

included (Left) Mr. Daniel Wong (Director and Head of Research & Analytics,

Hang Seng Indexes Company Limited), Mr. Mushtaq Kapasi (Chief Representative, Asia-Pacific,

International Capital Market Association), Mr. Pat-nie Woo (Member, Market

Development Committee, Financial Services Development Council) and Ms.

Dominique Duval (Sustainable Banking – Head of Asia-Pacific, Credit Agricole

Corporate and Investment Bank).

Dr.

Wilson Chan asked the following questions:

i)

Please briefly introduce the way(s) or measurement(s) from your

perspectives how to achieve the subjected expectation

ii)

The latest trends?

iii)

Key challenges and opportunities in the era of sustainability?

iv)

Investment in / values of green finance instruments? Or

v)

Future development expectation?

After finished

the part 1 of HKQAA symposium, we were invited to have lunch with guest speakers. I was in the table with Dr. Nigel Croft and

took a group photo.

I

recognized some new friends as follows:

Mr.

Glenn Lin (Managing Director, New Energy Financing and Consulting Limited)

(Left 1st in Row 2)

Ms. Song

Aolin (Project Manager, Capital Operation, China Energy Conservation and

Environmental Protection (HK) Investment Co., Ltd.) (Left 1st in Row

1)

Mr. Kado

Zhang (HKQAA) (Right 1st in Row 2)

Mr. Li

Peng (Assistant Director, Financial Innovation Division) (李鵬 – 金融創新處助理處長, 前海蛇口自貿片區管委會)

Previous HKQAA Symposium:

2016: HKQAA

Symposium – Startups Registration Scheme Kicks off - https://qualityalchemist.blogspot.hk/2016/05/hkqaa-symposium-startups-registration.html

2014: HKQAA

25th Anniversary Forum & Celebration Cocktail Reception - http://qualityalchemist.blogspot.hk/2014/11/hkqaa-25th-anniversary-forum.html

2010:

Part 1 - http://qualityalchemist.blogspot.com/2010/11/hkqaa-symposium-2010-sustainability.html ;

2010: Part

2 - http://qualityalchemist.blogspot.com/2010/11/hkqaa-symposium-2010-sustainability_26.html

Reference:

沒有留言:

發佈留言